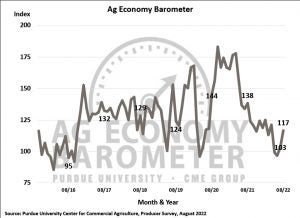

The Purdue University/CME Group Ag Economy Barometer farmer sentiment index rose 14 points in August to a reading 117. The rise in the overall measure of agricultural producer sentiment was driven by increases in both the Index of Current Conditions, which rose nine points to 118 and the Index of Future Expectations, which climbed 16 points to 116.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted between August 15 and 19, after the U.S. Department of Agriculture released both the August Crop Production and World Agricultural Supply & Demand Estimates reports.

As farmers get closer to the end of the year, pricing performance for crops and livestock is more evident. When the survey was conducted this past month, prices were particularly strong. Soybeans rose by about $1.50 per bushel, while prices for fall delivery of corn rose by about $0.25 per bushel. However, since the completion of the August survey, corn and soybean prices have dropped some.

The Farm Financial Performance Index rose in August to 99, which is 100 points higher than a month earlier and 18 points higher to its low point in May. Future expectations rose 16 points with farmers indicating fewer responses from those expecting future bad times for U.S. agriculture, and more responses from those expecting good times.

Despite this more positive outlook, there’s still a large amount of uncertainty among producers about the future costs of items. Input costs remain at the top of the list for concerns. While four out of ten producers expect input costs to decline by as much as ten percent in 2023 compared to 2022, over half expect input prices to rise from one to 20 percent.

Uncertainty among farmers about rising prices extends beyond crop input prices to consumer items as well. Nearly half of respondents this month said they expect the rate of inflation for consumer items during the next 12 months to be six percent or less. Examining responses to this question over the last five months reveals a shift away from expecting a low rate of inflation of three percent or less to expecting a higher rate of inflation of three to six percent. On the other end of the spectrum, the percentage of producers expecting very high inflation of over 10 percent declined from about one-third of respondents in the April through June surveys to 18 percent in the August survey.

Concerns over input prices are still limiting farmers’ large purchases. While there was a small improvement in the Farm Capital Investment Index in August, the change was a meager 3 points. For six months, the capital investment index has remained below 40 indicating that producers view now as a poor time to make investments. The number one reason? Prices increase. Despite poor sentiments regarding capital investments, 49 percent of respondents still plan to make investments.

Meanwhile, the Short-Term Farmland Values Index and Long-Term Farmland Value Index have remained relatively steady. Rise in interest rates doesn’t bode as well for farmland values, but there are a lot of positives such as interest from outside investors. Farmland purchases still hold a hedge against inflation because they aren’t directly correlated with the stock market.

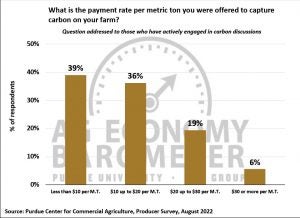

This month, survey respondents were also asked what their payment rate per metric ton was if they were offered payment for capturing carbon on their farm. Nine percent of respondents said they have engaged in discussions with companies offering payments for carbon capture. This is by far and away the highest percentage of respondents indicating they’ve engaged in carbon capture discussions with one or more companies.

In prior surveys, the percentage of producers talking to companies about receiving payments for carbon capture ranged from a low of just over 2 percent to less than 6 percent. Three-fourths of respondents said the payment rate per metric ton of carbon offered was less than $20. Two-thirds of respondents indicated that they required a payment rate of at least $30 per acre for them to participate in carbon capture programs.

Producers this month expressed more confidence regarding current conditions and future expectations. Despite uneasiness about what inputs costs will be for 2023 planting and inflation, producers were relatively optimistic about farmland values.